Op-Ed: The Red Line is on the wrong track

Oct. 17. [Analysis] By Kurt Naas. The Red Line commuter rail from Charlotte to Mooresville is back in the news again. Norfolk Southern has finally agreed to negotiate the sale of their tracks, Charlotte Area Transportation System (CATS) is kicking off a series of town halls, and Charlotte is proposing a county-wide sales tax increase of 1 percent to pay for it.

All of the Lake Norman towns as well as the Charlotte and Mecklenburg County boards have voted in favor of it. Despite the excitement (or maybe because of it), nobody seems to be asking the tough questions. Perhaps we should start.

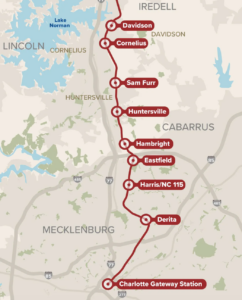

Red Line with 10 stops

Some background:

Taxing authority can only be granted by the state legislature, so local support is essential. If the legislature grants authority the issue will be put on the ballot as a county referendum, most likely in 2025. Legislation has already been drafted and it stipulates half of the tax receipts must go toward road improvements and the other half to public transportation.

The first issue is how the money gets distributed. For the road funding portion, instead of pooling the money and ranking projects county-wide, the proposed legislation balkanizes tax receipts among the towns based on their percentage of town-owned roads. Conveniently Charlotte will get 80 percent of the receipts designated for roads, or over $100 million per year.

Cornelius, meanwhile, will get a mere 2 percent. That’s a little over $5 million for roads with the same amount allocated to Red Line construction. It’s a pittance compared to Charlotte but if we were to raise the same amount through property taxes, it would amount to a 56 percent property tax increase! That’s a pretty hefty levy for a marginal gain but remember only half of the receipts got to roads.

Even if funds were pooled and allocated based on a ranking system, the legislation forecloses on Lake Norman having a fair shot at obtaining needed funding. Current road funding in Lake Norman is an afterthought because funding priorities are determined by the all-important Charlotte Regional Transportation Organization (CRTPO). Charlotte’s single delegate wields 42 percent of the vote, making what should be a regional planning body a de facto dictatorship.

As a condition of supporting the legislation the town board should have insisted we fix this. It’s impossible without Charlotte’s acquiescence, and the sales tax legislation is about the only thing on which Cornelius will ever have any political leverage over Charlotte. Instead the towns made it worse: the new legislation will create a new regional planning body to replace CATS, and Charlotte will get 45 percent of the vote!

What’s the cost?

Then there’s the issue of cost. Ominously, there is no current cost estimate for the Red Line. The most recent proxy is the Blue Line extension, a nine-mile route completed in 2018 at a cost $1.2 billion. The proposed Red Line is 23 miles long. Construction costs could easily run upwards of $2 billion if not more. That’s not pessimism, it’s history: Under CATS management, public transportation ridership is half of its 2010 peak, yet CATS’ budget has doubled. This is not sound operational management, yet you are being asked to pay and trust CATS will manage this mega-project on budget and schedule.

Do the math

Another issue is the viability of the Red Line as a transportation solution. Basic arithmetic shows this is an iffy proposition: Each day about 100,000 vehicles crawl through Lake Norman on I-77. So, for even half the utility of I-77 the Red Line would have to carry 50,000 trips per day, or 25,000 round trips. That averages out to 5,000 people per Lake Norman stop! Where will these commuters park?

Back in 2012 ridership estimates were so low the Red Line did not qualify for federal funding. The fact that there are no ridership estimates available today is concerning. Any mention of revenues from fare-paying passengers is conspicuously absent in public literature

And remember, that’s just half the utility of I-77—for $2 billion.

From a commuter’s perspective the Red Line is equally dubious: A one-way trip takes about 45 minutes, and trains will run every 30 minutes during rush hour. So the commute time will be the drive time to the station + wait time for train + travel time to downtown gateway + travel time to final destination. Miss the train and it sets you back another 30 minutes. What’s more likely is commuters will do the math and quickly figure out that, despite traffic hassles and private toll lanes, it’s still quicker on average to slog down I-77.

Granted the travel time should be more reliable, but we already have a “reliable travel time” solution with the private toll lanes (which we’ll be paying for until 2068).

No sunset provision

Also unsettling is what the legislation does not contain: A sunset provision. The sales tax will stay on the books until it is repealed by a county-wide vote. For all practical purposes, we are stuck with this tax forever.

Perhaps what’s driving this is the promise of high-density development along the route similar to what happened with the Blue Line in South End. But do we really want high-rise apartments in Cornelius? Do we really need to give developers additional incentive to build?

NAAS

With no cost or ridership estimates we’re being asked to commit to a new eternal tax to fund a multi-billion project managed by an entity with a poor track record.

The Red Line project needs to be placed on a siding until we get some answers.

—Kurt Naas

Naas is a former member of the Cornelius Board of Commissioners and the founder of WidenI-77, a grassroots effort that opposed private toll lanes on I-77.

7 Comments

Comments are closed.

The rationale for this gigantic expenditure does not pass the common sense sniff test. It has massive boondoggle written all over it. I certainly hope cooler heads prevail on this, but I’m not holding my breath.

Thank you Kurt. This project is insanity. I was disappointed to see Cornelius endorse it as a solution. It creates a sea of problems and solves none. A few busses would be way more cost effective, faster and far more useful. The public just needs an education on who to vote for and we need candidates willing to fight for the public. In nc you need a Governor willing to go against corrupt deals. Mark Robinson will be a big step in the right direction.

I agree this is insanity, but the guy we really need in the Governor’s office if we want smart action and not merely incendiary words is Jeff Tarte!

This op-ed stinks of Bias from Widen I-77 and wherever their funding comes from.

First it doesn’t make sense extrapolating the cost of Blue line by distance to Red line by distance without any of the differences of existing infrastructure between the 2 projects.

Then there is the line of thinking that the rail line is intending to ever take half the traffic burden of I-77 away. I have yet to see any estimate shared in writing of the proposed ridership and how much of the ridership is from cars versus existing bus infrastructure. If this is available I would appreciate a reply to this comment for my understanding. The Annual Average Daily Traffic (AADT) shared by NCDOT has I77 north of Huntersville between 50,000-100,000 with the area between I485 and I77 more than 100,000. This is an increase from I77 between Sunset and I485. See https://storymaps.arcgis.com/stories/78fd4ac44d63422c9d6c00bfae0bc996#ref-n-juX6nx While these ranges would be better with more granularity it shows that focused alternatives are needed for focused areas.

The Rail Line is as much about accessibility and alternatives to car-based infrastructure on both ends of the Rail Line as it is improvements to other transportation infrastructure.

Some questions everyone needs to ponder:

Since 1998, North Mecklenburg residents have been paying an extra half-cent sales tax. What was promised in return, and what have the North Mecklenburg towns received over the past 25 years?

Additionally, North Mecklenburg residents fund the maintenance of their section of I-77 they have to use to travel to the airport or Charlotte—not just for themselves but for all interstate users, including out-of-state trucks. Toll fees contribute to the upkeep of the entire road, not just the toll lanes. Given the savings to county, state, and federal governments from the road’s privatization until 2068, did North Mecklenburg receive proportional funding for other projects?

I appreciate the insightful thought in the op-ed however I think everyone agrees the status quo will turn our region into a traffic nightmare. Those who have lived in Atlanta have seen where just building more roads can lead. We are going to need a transit system which is faster than driving, convenient, affordable to operate and affordable to build.

Securing the Norfolk Southern right of way is a very important first step to creating a transit system for North Meck. It provides a 26 mile long, 100 foot wide easement from the Charlotte Gateway Station through the increasingly crowded northern towns. The price tag of $74 million is incredibly low for this purchase that provides us options. Although it should start at the Airport terminals rather than the uptown ballfield, I appreciate the local and city leadership for getting this first step done.

Now that we have a path for the Red Line, we need to discuss the transit we want to build there. Surface level transit (Bus and train) is speed limited to surface level traffic, accidents, weather and jay walking pedestrians. Furthermore, the frequency of surface level transit is limited to the width of the existing rail line which is just a single track for most of the line.

There is a subsurface option that would allow for the use of the entire 100 foot wide easement without moving roads or historic buildings that are presently encroaching the easement on the surface . This subsurface option or a system of dedicated underground tunnels is being built in Las Vegas right now for about $20 million per mile. If you consider 3 tunnels, one each direction and one for service, the cost would be roughly $60 million per mile. Recently, a new autonomous EV shuttle was announced that is designed to carry up to 20 passengers. This system of dedicated subsurface tunnels and EV shuttles has an estimated operational less than half that of traditional bussing. Perhaps most importantly, the speed at which this system could operate would allow one to get from Davidson to Uptown Charlotte in 20 minutes or less…. faster than you can drive yourself.

I think we should thank our representatives for securing the Norfolk Southern easement but then ask them to support a transit solution that is faster than driving, less expensive to operate than busing and less expensive to build than light rail or commuter rail. CATS is asking for input on the Red Line and if enough people ask for this future oriented transit system, we might just get it.

I kinda Wish these current and former board members would have had a height limit on the high horse the look down on everyone else with. Seriously. The only big problem with commuter rail systems are that the people funding them want to see immediate huge profits when they are a utility not a new retail store.